Are Employee Business Expenses Deductible For 2024 State

Are Employee Business Expenses Deductible For 2024 State – This process can cost money and depending on the state Employees If the employer doesn’t pay the business expenses of the sales employee, it’s possible for the employee to take tax . Stay updated on the standard deduction amounts for 2024, how it works and when to claim it. Aimed at individual filers and tax preparers. .

Are Employee Business Expenses Deductible For 2024 State

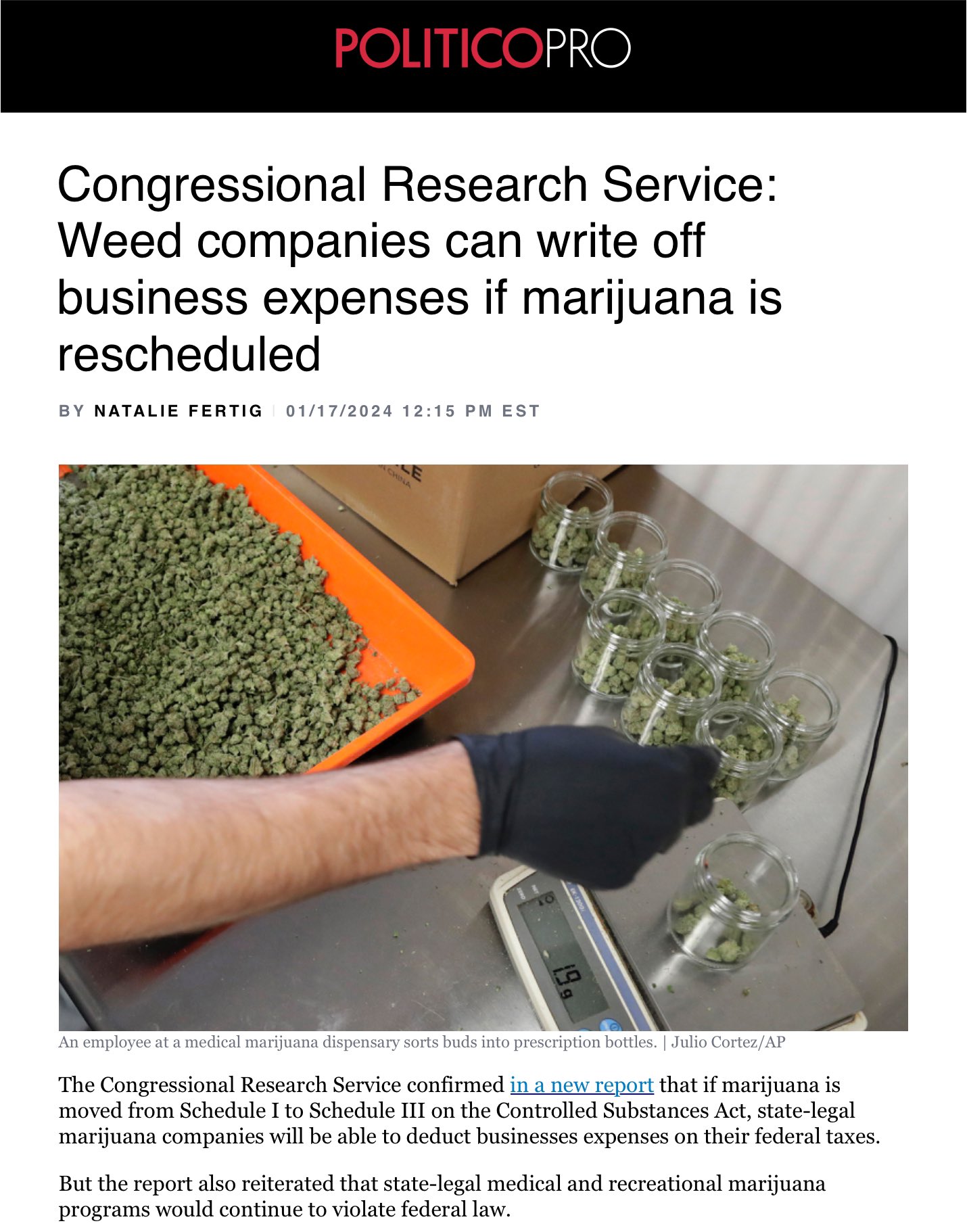

Source : taxfoundation.orgTodd Harrison on X: “🇺🇸 #cannabis 🌿 https://t.co/LEN9R7xeqK” / X

Source : twitter.com2024 State Business Tax Climate Index | Tax Foundation

Source : taxfoundation.org25 Small Business Tax Deductions To Know in 2024

Source : www.freshbooks.com2024 State Business Tax Climate Index | Tax Foundation

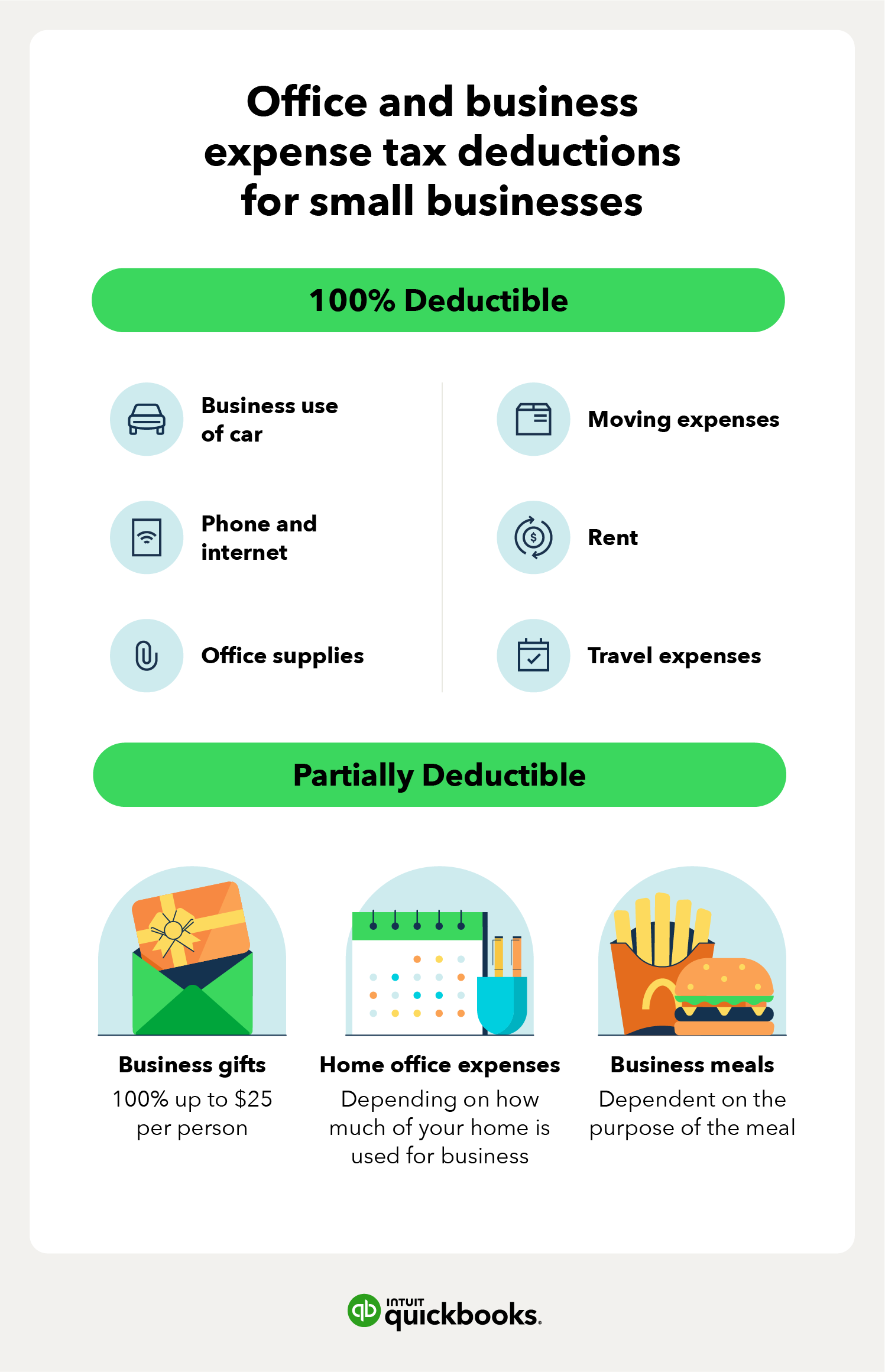

Source : taxfoundation.orgSmall Business Expenses & Tax Deductions (2023) | QuickBooks

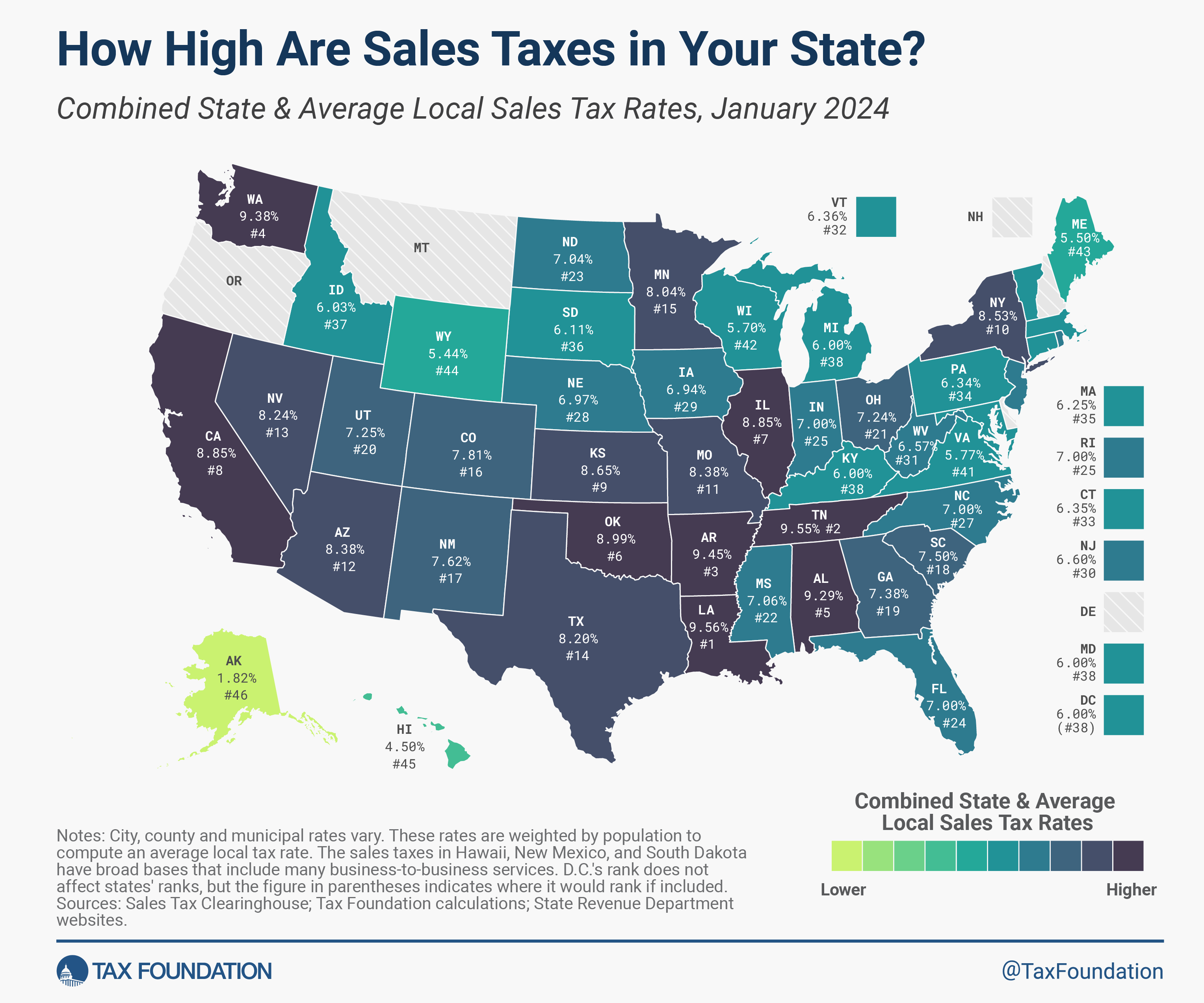

Source : quickbooks.intuit.com2024 Sales Tax Rates: State & Local Sales Tax by State

Source : taxfoundation.orgThe Ultimate 2024 Tax Deductions Checklist for Insurance Agents

Source : blog.newhorizonsmktg.comSmall Business Expenses & Tax Deductions (2023) | QuickBooks

Source : quickbooks.intuit.comTodd Harrison on X: “🇺🇸 #cannabis 🌿 https://t.co/LEN9R7xeqK” / X

Source : twitter.comAre Employee Business Expenses Deductible For 2024 State 2024 State Business Tax Climate Index | Tax Foundation: The IRS began accepting tax returns on January 29, 2024 deduction, though, you can opt to itemize deductions for certain expenses, including things like property taxes, mortgage interest . Generally, this deduction is only available to the self-employed; employees typically 2023 or $69,000 in 2024 [0] Yes, you can deduct self-employment tax as a business expense. .

]]>